Types of Orders

Currently, the types of orders are divided into 3 categories: Market, Limit and Stop

Market orders

Market orders are orders that, when sent, have immediate execution, that is, from their dispatch confirmation, the operation is executed according to the prices available in the order book at that exact moment, therefore, the best available price for trading that volume at runtime.

It is important to remember that due to immediate execution it is not possible to configure the price of the operation, therefore, orders from the top of the order book will always be executed as a counterparty.

Limit orders

Unlike market orders, in limit orders it is possible to stipulate a price for the operation, that is, your purchase or sale will only be executed at the price you define at the time of opening the order.

Limit orders are passive orders and are allocated in the order book until they are executed.

Furthermore, it is possible for your limit order to partially execute before being fully executed or not to be fully executed depending on the amount of counterparties trading at the price you have determined.

Within the opening of a limit order we have 4 types of options:

Good till canceled

This option establishes that your order will remain open until it is completely executed or canceled manually.

Immediate or Cancel

This option establishes that if the order is not executed completely, the amount that was not executed will be cancelled. For example, suppose you want to buy 2 BTC for $20,000.00 and you opened your limit order, but it partially executed and bought only 1 BTC at that price, after partial execution you would have only bought that 1 BTC and your order would be canceled after that , not executing the remainder of the amount.

Fill or kill

This option is for your order to be executed immediately and completely or to be cancelled. Basically, the system will check if the order book has enough volume to execute its amount completely at the defined price, if not, the order will be cancelled.

Post only

This option is used to prevent your limit order from being filled as a market order due to price variation, this can help in case prices changes too quickly for you to set a new limit order.

For instance, if BTC is at market price of $20.000,00 and you wish to buy 1 BTC at $19.995,00, but while you are setting your limit order the price changed to $19.980,00 the traditional limit order will be filled as a market order, since the price is lower then the trigger you set, but, if you set a limit order Post Only, the order will be canceled instead of being filled.

Stop Ordens

The stop order basically fixes the buy/sell of an asset when its price exceeds a certain point on the chart, limiting the investor’s loss or consolidating a profit.

Once the price crosses the predefined entry or exit point, the order is executed.

Stop orders come in a few different variations, but they are all effectively conditional based on a price that is not yet available on the market once the order is originally placed. As soon as the futures price is available, a stop order will be triggered, but depending on the type, the broker will execute it differently.

Stop Limit

The stop limit order is divided by two parameters: stop price and limit price.

The stop price is the price at which the order will be triggered by placing it in the order book, the limit price is the price of the limit order that will be placed in the order book as soon as the market reaches the stop price. Therefore, the moment your stop price is reached, your limit order is entered in the order book.

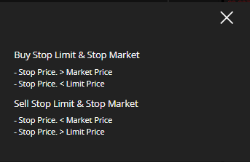

To open a Stop limit order, it is necessary to follow some rules regarding the prices entered:

Stop Market

Stop market orders have a single parameter: the stop price.

When the stop price is reached, an order is placed on the market, executing the trade at the time the trigger was activated.

To open Stop Market orders it is also necessary to follow some rules: